Quote & Buy Travel LX Travel Insurance

Why Travelers Trust Travel LX

Overview of Plan:

Travel Insurance Coverage Ideal for Luxury Destinations

The iTravelInsured Travel LX plan provides the highest level of benefits for the more discerning travelers. This plan is ideal for travelers going to remote and exotic locations worldwide.

With iTravelInsured Travel LX you may recover non-refundable, unused payments and deposits when a trip is cancelled or interrupted for a variety of covered reasons. Benefits are also provided for travel delays, baggage delays, and emergency medical treatment while you’re away from home.

Separate from these benefits, IMG can provide non-insurance emergency travel assistance, such as helping you replace lost travel documents or lost prescriptions, emergency cash transfers, and legal and medical referrals when necessary. This plan also offers access to 24/7 non-insurance telehealth services. Use Teladoc to connect with a board-certified medical professional who can help diagnose, treat, and prescribe medications for many non-emergency medical issues over the phone or through online video consultation.

Benefits:

|

Trip Cancellation |

100% of trip cost up to $150,000 |

|

Trip Interruption |

150% of Trip cost |

|

Trip Delay |

$250 per day per person; maximum benefit $2,500 |

|

Change Fee |

$300 |

|

Frequent Traveler Reward |

Up to $75 |

|

Single Supplement |

Included |

|

Rental Car Damage and Theft Coverage |

Up to $40,000 per covered vehicle |

|

Missed Trip Connection |

Up to $500 |

|

Traveling Companion Bedside Companion Daily Benefit |

$200 per day up to a Maximum of $1,000 |

|

Pet Kennel |

$100 per day up to a maximum of $500 per pet |

|

Medical Evacuation and Repatriation of Remains |

$1,000,000 |

|

Search and Rescue |

$10,000 |

|

Political or Security Evacuation and Natural Disaster Evacuation |

$50,000 per Political or Security Event and per Natural Disaster Event |

|

Baggage and Personal Effects |

$1,500 subject to a per item maximum of $250 |

|

Baggage Delay |

$250 |

|

Accident & Sickness Medical and Dental Expense |

$250,000 $1,000 dental sublimit |

|

Accident Death and Dismemberment (Common Carrier) |

$100,000 |

|

Optional Cancel for Any Reason/Interruption for Any Reason |

Available as optional buy-up if purchased within 20 days of initial trip payment or 75% of non-refundable trip cost |

|

Pre-existing Medical Condition Exclusion Waiver |

Available if purchased within Time Sensitive period |

|

Worldwide Travel Assistance |

Yes |

|

Telemedicine |

Included with Teladoc |

Eligibility:

Maximum benefits listed are per insured person

Minimum Trip cost $500

Minimum Age 0 (1 day)

Max age 99

Benefits for WA residents vary. Please review policy details. CFAR not available for NY residents*

Coverage is primary

Single trip

180-day max trip duration (NY and WA limited to 90 days)

10-day free look period

3 Year booking window

$2.00 teladoc fee per insured is itemized separately

Note that Base plan without CFAR references Time Sensitive period as at or before final payment for pre-existing waiver. Also impacts natural disaster and hurricane benefits under TCAN/TINT

Plans with CFAR buy up reference Time Sensitive period as within 20 days of initial trip payment or deposit. This impacts pre-existing waiver, CFAR/IFAR coverage, Natural disaster, and hurricane benefits under TCAN/TINT

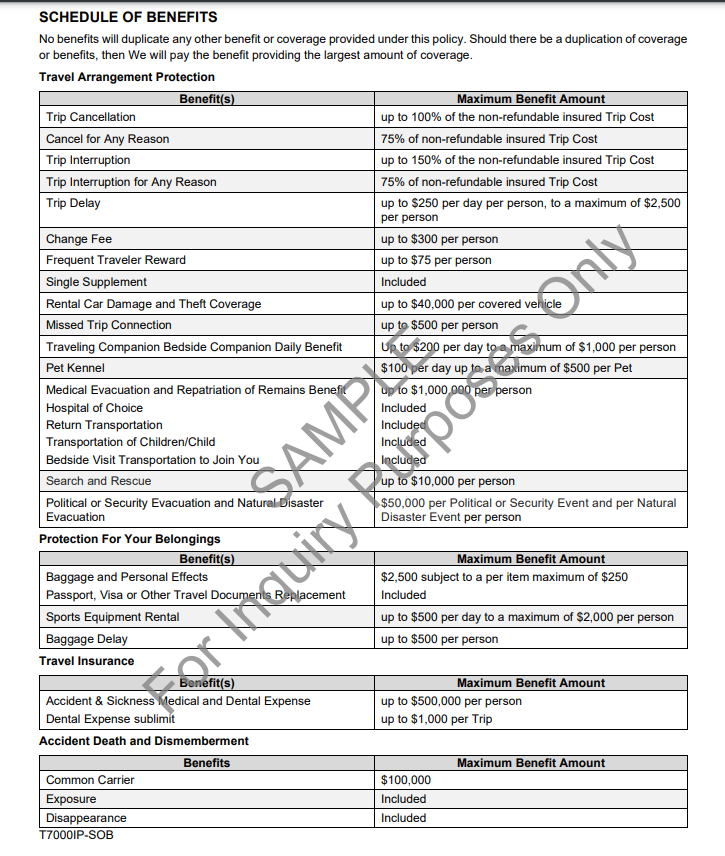

Schedule of Benefits for base plan with CFAR: